Home Equity: Make Your House Work For You

The equity you have in your home can be one of the most powerful financial tools you have. From paying for home improvements to consolidating debt, your equity can provide the cash for all sorts of projects and payments.

How to Calculate Your Home Equity

Essentially, equity is just an equation that represents how much more your home is worth than what you owe on it. To calculate how much equity you have, figure out your property's value and subtract any loans you have against it.

You will often see equity expressed in terms of LTV, which stands for "loan-to-value," and is a ratio of debt to value. In our previous example, you have a total of $300,000 borrowed against the house, which is worth $400,000. Dividing $300,000 by $400,000 gives us an LTV of .75 or 75%.

Use our home equity loan payment calculator to help you plan how to use your home's equity.

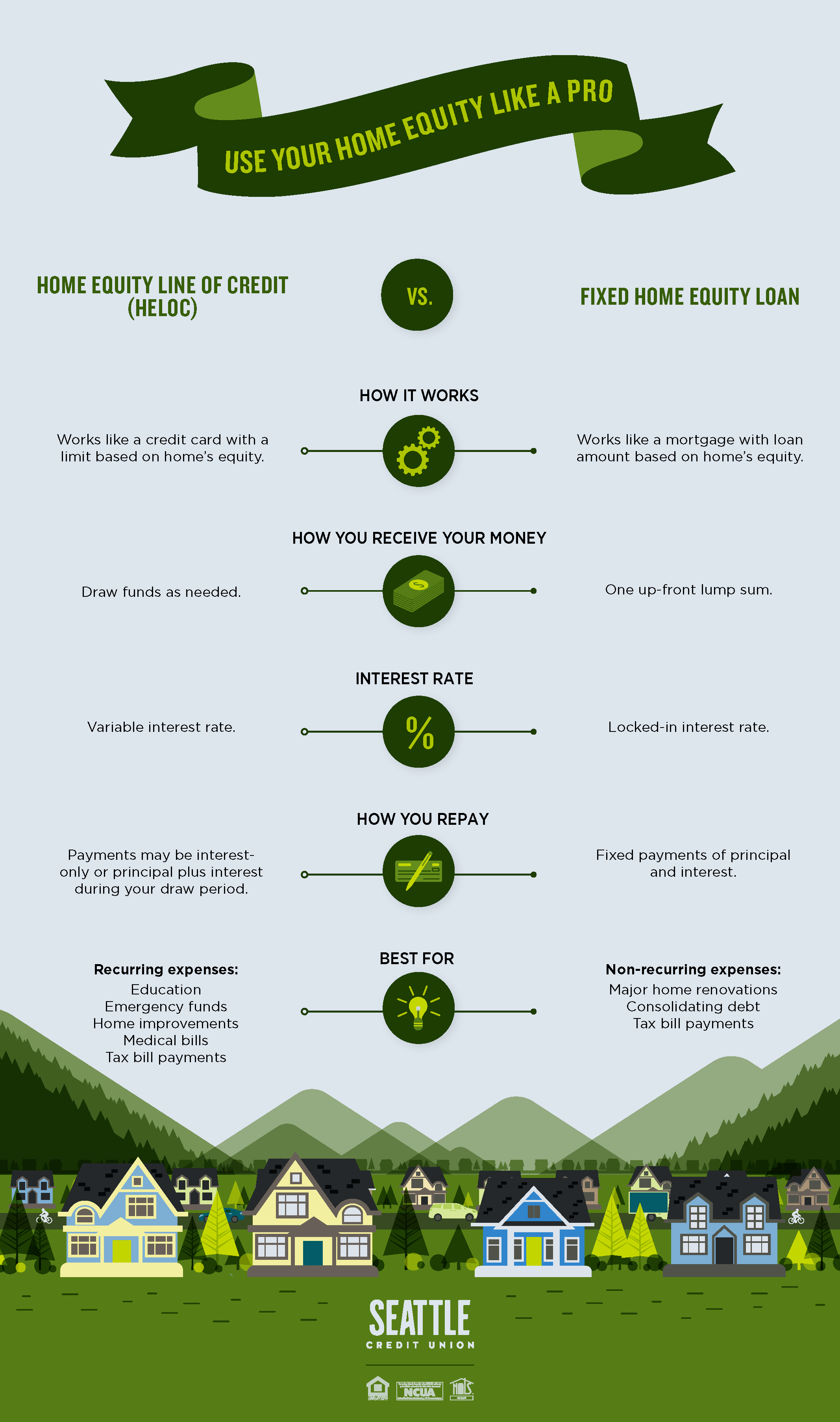

Home Equity Loans VS. HELOCs

Now that we know what equity is and can figure how much we have, how do we get to it?

This is where an equity loan or Home Equity Line of Credit (HELOC) comes in. These are loans you get in addition to or instead of a mortgage that use your home as collateral. You may also hear these loans called second mortgages.

Equity loans and HELOCs are very similar but have some important differences.

What is a home equity loan?

Home equity loans are usually fixed-term loans where you receive all of the loan up front. They can be fixed-rate, meaning the rate stays the same for the entire loan, or variable-rate, which means the rate can change as you pay it back. Most of the time, equity loans are used for one-time projects, like a bathroom remodel, or in other instances where you need all the money at once, like for debt consolidation.

What is a home equity line of credit (HELOC)?

HELOCs work a lot like a credit card. When you are approved for a HELOC, you are given a limit based on your available equity, and you can make advances up to that limit. You can advance all of the limit at once or a little bit at a time as you need it. When you make payments toward your HELOC, the amount you pay toward principal becomes available for you to borrow again. HELOCs usually have a period of time you can make advances, called the draw period, and a period of time after that during which you only make payment, called the repayment period.

During the draw period, you pay a percentage of your outstanding balance each month. That amount can change depending on how much you owe at the end of the month. Once your HELOC switches to the repayment period, your monthly payment will be an equal amount each month, so that your balance is paid in full by the end of the repayment period.

What Can You Do With Your Home Equity?

You can use funds from an equity loan for just about anything. For example, you can:

- Make home improvements and repairs

- Pay for educational expenses

- Consolidate debt to reduce your total monthly payments

- Buy a second home or investment property&

- Pay for emergency expenses, like car repairs

- Pay your taxes

QUESTIONS?

Your equity can be a powerful tool in your financial portfolio. If you are considering opening an equity loan or HELOC or just have questions, take a look at our home equity offers or contact our mortgage lending experts. They will sit down with you and talk about your goals and work to find the loan that works best for you. Call us today at 206.398.5888 to get started.